Press release

National not-for-profit health insurer HIF remains the best value health insurer for members following the Federal Government’s premium increase announcement this morning.

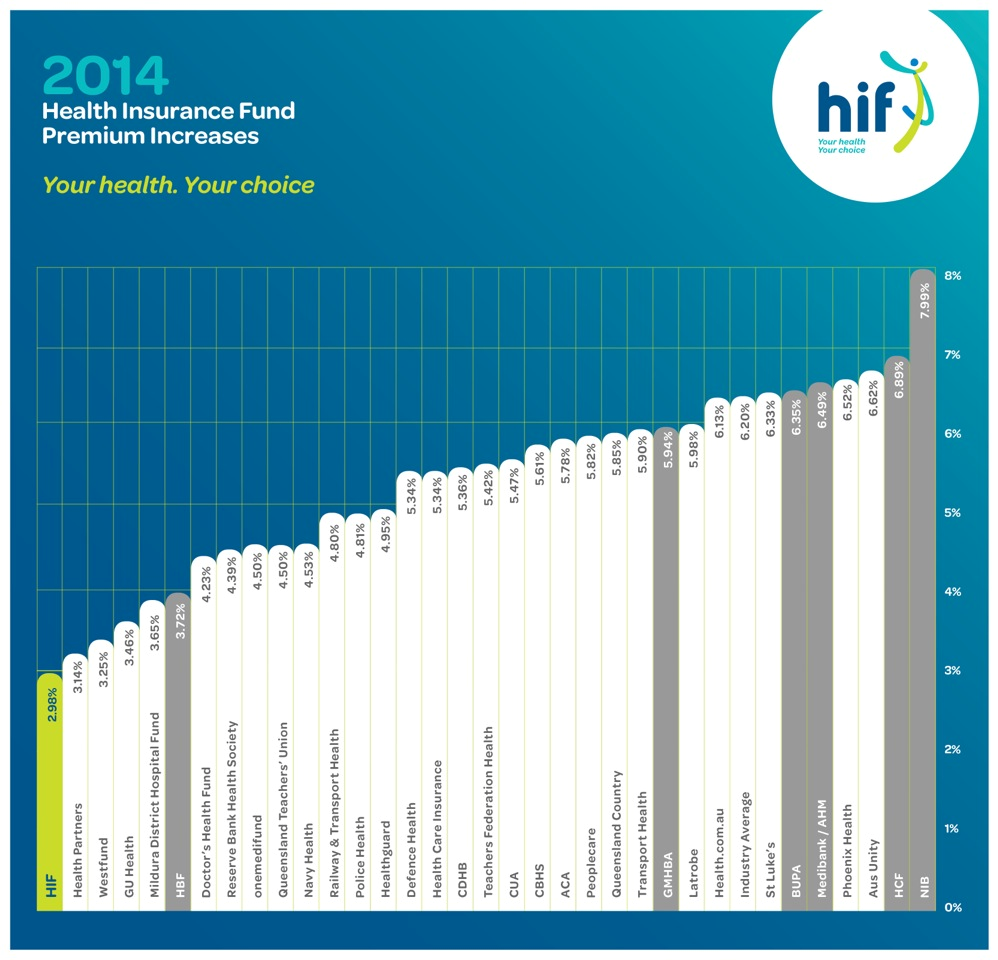

The Government approved premium increases, with the weighted average annual increase in private health insurance for 2014 at 6.2 per cent, while HIF has an increase of just 2.98 per cent – significantly lower than all other funds.

HIF managing director Graeme Gibson said “We work hard to provide the best value policies for our members and to keep price rises down to the minimum necessary. It's in our DNA. This is the eighth consecutive year that HIF's annual increase has been below the industry average and in WA the eighth consecutive year it has been below five per cent.”

Want more information? Here's some quick FAQs.

1) Why do premiums go up each year?

Each year on April 1, the health insurance industry (all funds inclusive) raises premium rates on existing products. A number of factors lead to these increases, for example: rising health related expenses, increased doctor charges, medical equipment and technology, increases in claims frequency, and more. The Australian Bureau of Statistics recently reported that health care costs had increased by 4.1% in the year up to 30 September 2013. Like all other health insurers, HIF must adjust our premiums accordingly. However, we will keep our 2014 weighted average premium increase at 2.98%, which is well below 4.1% and well below all other funds.

2) How do other funds compare this year?

Here’s a quick overview of HIF’s 2014 premium increase in comparison to other major funds. See the graph below for a full breakdown of all 36 health funds.

| - 5.94% - GMHBA

- 6.35% - Bupa

| - 6.20% - INDUSTRY AVERAGE

- 6.49% - AHM

| - 6.49% - Medibank Private

- 7.99% - nib

|

3) Does HIF profit directly from premium increases?

No. Unlike some Australian health funds, HIF is a member-owned, not-for-profit company. This means that the company has no shareholders to report or distribute profit to. Any net operating margin earned as a result of this rate rise will be directly added to the fund’s reserves to ensure the future payment of claims and reduce pressure on any future premium increases. The Board of HIF, whose role is to represent the best interests of members, would not be acting responsibility if rates were not increased at this time.

4) I’m an HIF member. By how much is my membership contribution increasing and when are the new rates effective from?

The exact details of how the premium increase will affect you personally will be communicated to you in writing prior to the 1st of April 2014.

5) I’m currently with another fund but I’d like to switch to HIF. What do I need to do?

Switching to HIF is easy as. Simply visit www.hif.com.au and join online (it only takes a few minutes). During the online application process, we’ll ask for the name of your current fund, your member number there, and your authorisation to contact your previous fund on your behalf - then we do everything else! No forms to fill in, no paperwork, nothing. We’ll also honour your previous length of membership, meaning that you receive the highest benefits applicable to your new level of cover, and you don’t have to re-serve any unnecessary waiting periods.

Media contact: LastSay Communications, Donna Cole on 0419 901 229