The Health Insurance Fund of Australia (HIF) remains one of Australia’s most competitively priced health insurance funds following the Federal Government’s premium increase announcement today.

While HIF’s latest average annual increase was higher than previous years, HIF has a track record of keeping premiums as low as possible.

HIF managing director Graeme Gibson said,

‘“Each year we work hard to provide the best value policies for our members and keep price rises down to the minimum necessary. This year’s average increase of 7.99 per cent was influenced by several factors, including the rising cost of health care, and increasing member claims.

HIF has kept its premium increases low year after year. In both 2014 and 2015, we had the lowest average premium increase of all Australian health funds open to the public, and in 2015/16 we paid out 94.8 cents back in rebates for every dollar of premiums that came in compared to the industry average of 86.1 cents.

Mr Gibson urged HIF members and consumers to be careful if they intend to shop around, and make sure they consider which fund is the best value for money based on all the key elements.

"If you’re going to compare your cover with cover from other funds, make sure you compare the same or similar policies, and consider all the really important policy-related factors, including benefits, annual limits, excesses, benefit exclusions and restrictions (if any), and don’t overlook customer care. And if you want to compare different health funds’ percentage rate rises, look at their last five years’ track record – this will give a much clearer idea of who’s most competitive over time.

Focus on the actual price of the same or similar covers, not just the percentage rate rise, and compare it to what you’ll get back or likely get back when you need it, that is, the claim-to-premium levels. What percentage of premiums does a health fund pay back to or on behalf of its members in benefits?”

Mr Gibson also urged HIF members to consider pre-paying premiums before April 1, to avoid the rate rise this year. “We remain among the most price and value competitive health funds in Australia.”

For all media enquiries: Please call Donna Cole on 0419 901 229.

Why do premiums go up each year?

Each year on April 1, the health insurance industry (all funds inclusive) raises premium rates on existing products. A number of factors lead to these increases, for example: rising health related expenses, increased doctor charges, medical equipment and technology, increases in claims frequency, and more.

Why are health costs rising more than the Consumer Price Index (CPI)?

The annual health insurance premium increase reflects the rising cost of healthcare overall. The Consumer Price Index only reflects price increases for a pre-defined range of goods including food and clothing, and is currently held down by the falling oil/petrol prices. As CPI does not reflect an increase in private healthcare usage, it simply can’t be compared to a health insurance premium increase.

Why is my premium increasing by more than the HIF average percentage?

The average percentage increase is an average across all policies, states and territories, but each product is priced individually depending on the increasing health care costs associated with that product in each state or territory. For that reason, some of our rates have gone up less than the average and some more – depending on the costs associated with the particular product or location. This year’s adjustment to the Federal Government Rebate will also result in a reduction of the discount you receive off the price of your policy by the Government. The erosion of the rebate is driven by the Government and is not a decision implemented by HIF. It’s also important to note that the rebate does not apply to any Lifetime Health Cover Loading (LHC), effective from 1/07/2013.

How will the premium increase affect me if I’ve paid my contributions in advance?

If you pay your premiums prior to 1 April, you will enjoy rate protection for that time, including other changes that may impact your premium after April 1 such as the reduction of the Federal Government Rebate. That means that you will pay your premiums at the current rate for the duration of that upfront payment, which can be 12 months worth of premiums, 6 months, 3 months, 1 month or one fortnight. If you do choose to make an upfront payment of 12 months, you will also receive an additional bonus discount of 4% (or 2% for six monthly payments).

Does HIF profit directly from premium increases?

No. Unlike some of our competitors, HIF is a member-owned, not-for-profit company. This means that the company has no shareholders to report or distribute profit to. Any net operating margin that is earned as a result of this rate rise will be directly added to the fund’s reserves to ensure the future payment of claims and reduce pressure on any future premium increases. The Board of HIF, whose role is to represent the best interests of members, would not be acting responsibility if rates were not increased at this time

I’m an HIF member. By how much will my standard contribution increase and when are the new rates effective from?

The exact details of how the premium increase will affect you personally will be communicated to you in writing prior to April 1.

I’m currently with another fund but I’d like to switch to HIF. What do I need to do?

Switching to HIF is easy as. Simply call us on 1300 13 40 60 or join online (it only takes a few minutes). During the online application process, we’ll ask for the name of your current fund, your previous member number and your authorisation to contact your previous fund on your behalf - then we do everything else! No forms to fill in, no paperwork, nothing. We’ll also honour your previous length of membership, meaning that you receive the highest benefits applicable to your new level of cover, and you don’t have to re-serve any unnecessary waiting periods.

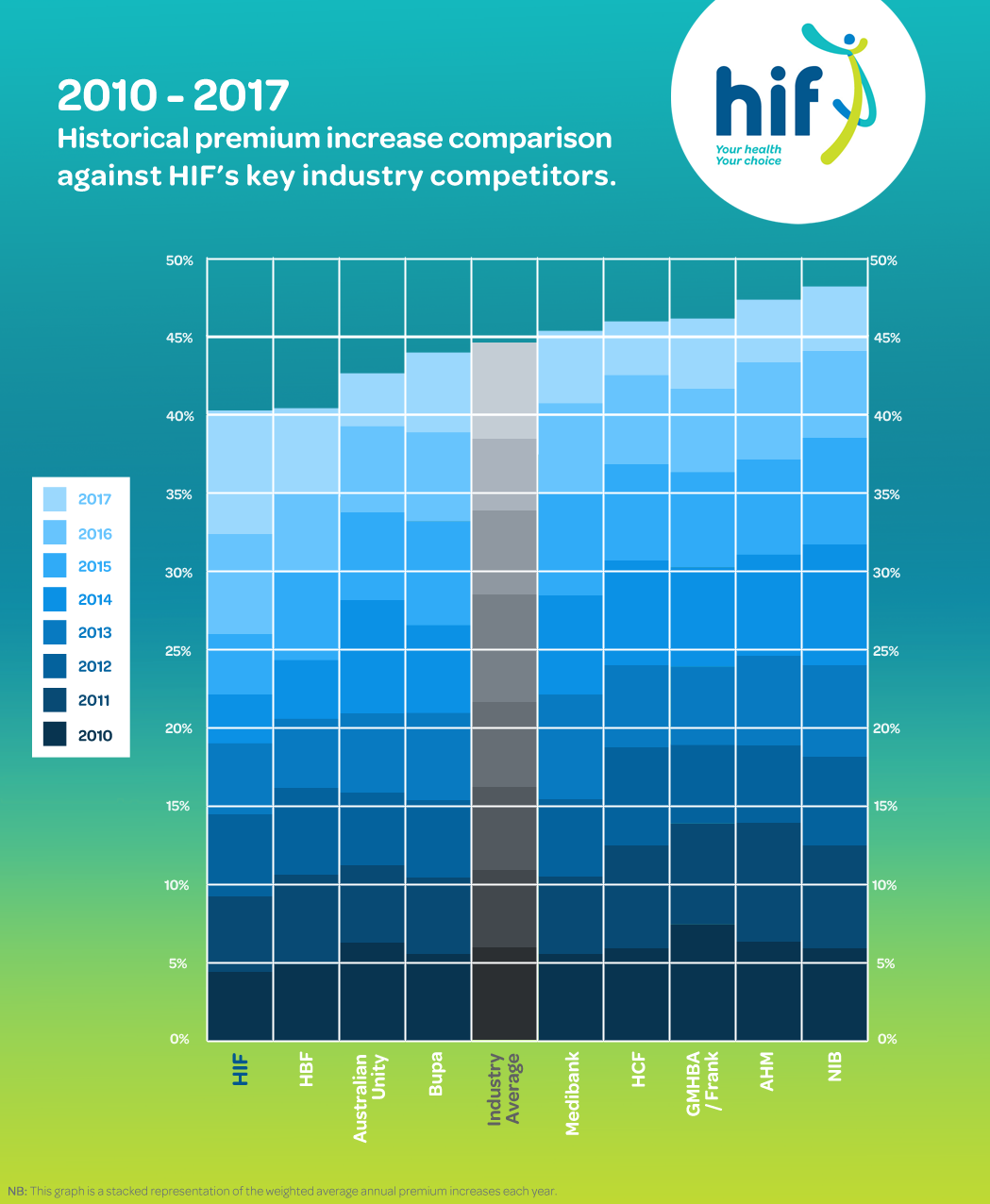

How does HIF’s increase compare with other funds?

Please refer to the graph below for a eight year comparison against HIF’s major industry competitors.